Cash In

and Earn-Out

September 22, 2015 ● 3xEquity

The importance of an earn-out provision when buying an advisory practice

With 10 year SBA loans going for as low as 4.4%, it has become easier for advisors to offer a big upfront check to grease the wheels on an acquisition. Be cautious; what you do to entice an advisor to sell, could cost you severely after that advisor has left the practice. Once a selling advisor collects his last check, the motivation to assist in the transition is gone.

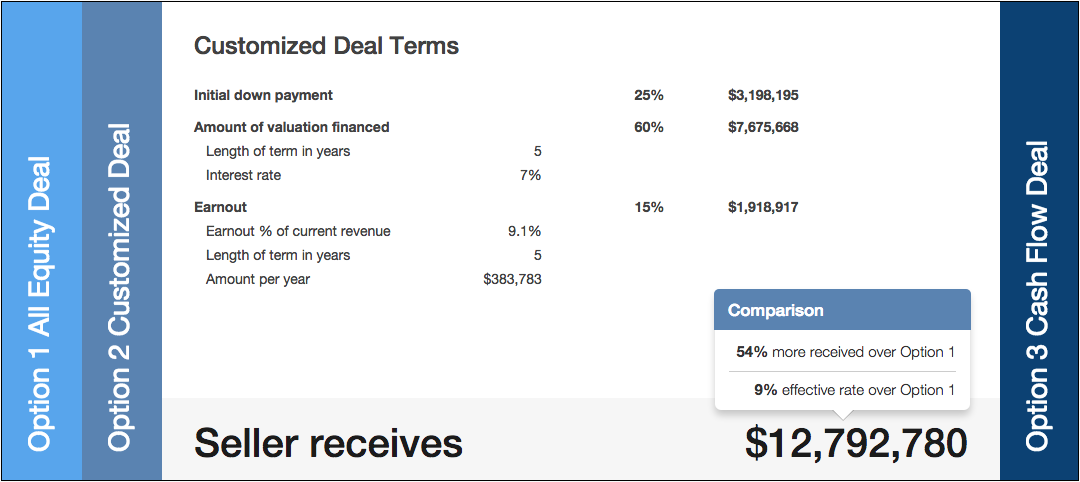

Enter the earn-out. An earn-out stipulates that the seller of the business will receive a certain percentage of the revenue from the practice for a set period of time after the sale of the practice. See below for an example of a typical deal structure using the “Deal Terms Tool” from 3xEquity.

When an advisor has skin in the game for a period of time after completely exiting the practice, there is significant incentive to have a strong transition. The earn-out percentage is negotiated as part of the overall deal along with the down payment and any percentage of the deal that is financed as a note.

This structure helps clear up any debate about the growth potential of the business, which is typically a large road block in negotiations. If the growth rate of the revenue is not as high as the seller states than the length of the earn-out will automatically increase to adjust for the lack of growth. The same is also true if the growth is greater than expected, then the length of the earn-out is shortened and the seller is paid off quicker than originally planned.

3xEquity recommends having at least 20% of the deal be structured as an earn-out, with the percentage of revenue being no more than 10%.

Everything is negotiable in the beginning when structuring an acquisition, but once that deal is set in cement it is almost impossible to change it. Be sure sure to utilize the tools which are available to you to make the right decisions early on in the negotiation process.

For more ways to help your business, visit www.3xEquity.com